Please complete the Change in Business Status Form.

Need to change or update your business information? Online tax returns cannot be filed until you receive your tax form with your account number & PIN.Įmail: FORMS AND INFORMATION REGARDING TAXES Jordan Tax Service will mail Tax Forms at the beginning of February. Non Resident Sports Facility Usage Fee Regulations Local Services Tax- Employers & Self-Employed Regulations

Institution & Service Privilege Regulations For any questions, call 41 Option 2 for Business Tax.

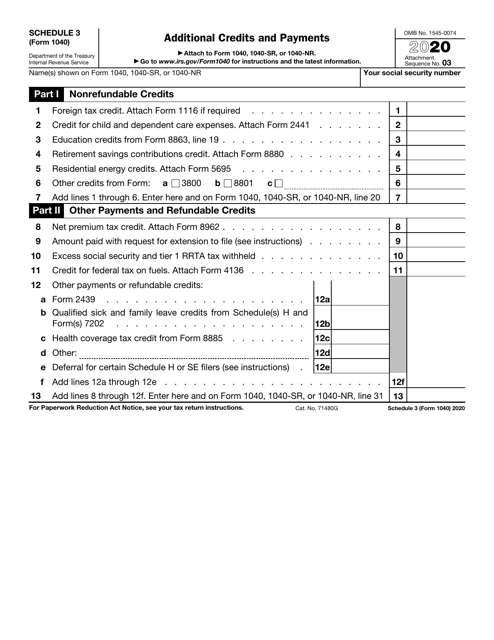

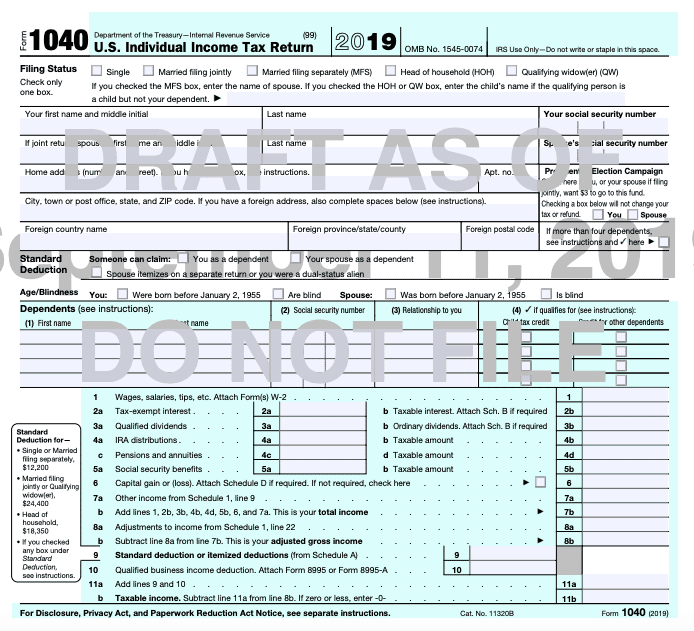

Please refer to the chart below for Tax and Fee information. Interest and penalty will be applied to all payments received after their respective due date. Internal company post meter stamps are not proof of timely filing. The United States Post Office postmark will be the only proof of timely filing accepted. Failure to complete the Tax Forms correctly may result in additional interest and penalty.Any interest and/or penalty caused by the delay in incorrect information will the responsibility of the taxpayer. Tax payments for unregistered businesses will not be accepted. Tax Returns that are received by the Department of Finance and are NOT registered will be returned to the taxpayer along with a registration form.Please Click Here if you need a City ID number. Any entity conducting business within the City of Pittsburgh must be registered with the City of Pittsburgh and have a City ID Number.Form 1040: 2017 U.S.Tax Forms IMPORTANT INFORMATION FOR CITY OF PITTSBURGH TAXPAYERS.Form 2019: Self-Employment Tax May I Use Short (IRS).Form W-10: Dependent Care Providers Identification and Certification (IRS).Form 1117: INCOME TAX SURETY BOND (IRS).Form 2015: Profit or Loss From Business (IRS).Form W-4: Employees Withholding Certificate (IRS).Form 4506-C: IVES Request for Transcript of Tax (IRS).Copy A of this form is provided for (IRS).You may file Forms W-2 and W-3 electronically (IRS).Form W-9: Request for Taxpayer Identification Number and (IRS).The IRS provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. The Internal Revenue Service (IRS) is a government agency responsible for collecting taxes and administering the federal statutory tax laws of the United States. Use our library of forms to quickly fill and sign your IRS forms online. Individual Income Tax Return (IRS) form is 2 pages long and contains: On average this form takes 27 minutes to complete All forms are printable and downloadable.įorm 1040: 2020 U.S. Once completed you can sign your fillable form or send for signing. Use Fill to complete blank online IRS pdf forms for free. Fill Online, Printable, Fillable, Blank Form 1040: 2020 U.S.

0 kommentar(er)

0 kommentar(er)